Now operating 22 factories in Germany, Italy, France, Switzerland, Poland, Austria, Russia, Japan, China and USA, plus sales offices elsewhere, the view from the top of the newly-combined operations is starting to look different, says chairman of the executive board of DMG Mori AG, Dr Rüdiger Kapitza.

Seen from a newly enlarged global perspective, the boom-and-bust cycles of machine tool sales in national markets have evened out, he says: “There are no true cycles any more. We used to see troughs and peaks. Now the market is rather flat; some countries are doing well, others are not. There is no dominant trend.” Kapitza observed this at a January press conference held at DMG Mori’s annual Open House event in Pfronten, Germany.

The business estimates that worldwide 2015 machine tool consumption fell by 4%, compared to 2014, to about €59 billion. Kapitza predicts 2016 will be “calmer” than last year and return to 2014 levels: European growth is likely to be stable at about 4%; Russia (where DMG Mori opens a technical centre in May), is likely to be down, but India, Thailand and Japan will be up.

DMG Mori production is becoming ever-more standardised: 300 different models of machine at merger are being winnowed down to 220, with an ultimate goal of 130-150, says CEO of DMG Mori Company Ltd, Dr Masahiko Mori. Also, key components are going to be more standardised, for example in spindles – 3,000 per year are manufactured in Pfronten – and the new ToolStar servo-drive automatic tool change system, also made in Germany, is available for all toolchanger machines.

At the same time, application-specific expertise is coalescing in a few places worldwide. An aerospace centre of excellence has been set up at the Pfronten factory, helping to better machine complex aerostructures, and Mori says that branch offices will be set up in Chicago, Los Angeles, Tokyo and Singapore. For motorsport, DMG Mori is collaborating with Porsche in a research and development lab that undertakes low-volume prototyping and production. In additive manufacturing, the business has plans to install an AM machine at Singapore’s Advanced Remanufacturing and Technical Centre, in the same country that DMG Mori has already set up an AM centre of excellence for customer applications and development work. Another unit arrives at the UK’s Advanced Manufacturing Research Centre, on the Advanced Manufacturing Park near Sheffield, later this year.

UK DEVELOPMENTS

Staying with the UK, DMG Mori UK managing director Steve Finn, who celebrated 35 years of service in the industry last month after starting as an application engineer at Tarex Berger, says that the UK subsidiary nearly reached its UK sales targets for 2014, although he did not divulge numbers; for the 2016 MACH year it is set to grow about 7.8%, one of the largest growth predictions worldwide (third after India and Thailand).

Last year, he says, the company’s new equipment sales organisation was reorganised into 15 areas across the UK, each with a maximum of 350 potential customers controlled by a single area sales manager. These staff are trained in Pfronten, and sign up to a code of conduct. They are supported by a team of product managers, eight applications engineers, 35 service engineers and two apprentices, following an old scheme by Mori Seiki (DMG Mori Co’s previous name) that was only restarted last year.

On the topic of service, Finn is eager to set the record straight: “We continue to try to improve service; we know we’re not perfect.” A service performance measurement system long used on the ‘Mori Seiki’ side of the business has but only recently been implemented on the ‘DMG’ side. For that reason, average call-out time for ‘DMG’ products, pre-merger, was three weeks; now it is below 1.5 days. In comparison, over the past three years, ‘Mori Seiki’ call-out times have averaged about 0.8 days. According to Finn, 95% of spares, sent from a warehouse near Munich, Germany, reach customers within 24 hours of being shipped.

At the Pfronten Open House, quality and productivity as differentiators in a crowded marketplace was a theme of some machines launched. Two of the six models receiving their world première at the event involve additional technology on top of a DMG Mori monoBLOCK machine base. First is the second-generation Sauer Ultrasonic range: new software and a new specialised ultrasonic toolholder with increased amplitude of oscillation (to 10 micron) improve ultrasonic machining performance for cutting hard materials and composites. It is said to uniquely combine ultrasonic grinding with high speed cutting; more powerful drive motors are also included.

Second is the Dixi 125 high precision vertical machining centre made by the Swiss subsidiary of the same name. Dixi’s laborious hand-scraping of guideways, plus the addition of a laser-based spindle tracking and calibration system, together with extensive cooling systems, help the machine achieve 15 micron tool centre point accuracy throughout the working volume of the machine, and straightness to 3 micron. Four other models in different sizes are offered.

Example of surface finish achieved using Siemens’ new 'Top Surface' spline-optimising module, as cut on a DMG Mori HSC 70 linear from aluminium

CNC software improvements at the event include the ‘Top Surface’ feature set to optimise groups of surface points (splines) that is part of the Siemens CNC package fitted to, in this case, an HSC 70 linear.

Increasing productivity were many different types of automation systems, at large and small scales. For example, in the factory Machinery saw one of the first automatic pallet changers being constructed, an RS 12-pallet unit for the DMC 80 FD duoBLOCK. Of course many other machines boast pallet changers too, including the twin-pallet duoBLOCK 160 that was a world première at the event. It also boasts new exterior design and Magnescale measurement system for axis travels, which are 1,600 by 1,600 by 1,100 mm in X, Y and Z.

ADDITIVE DEVELOPMENT

Although there were no new combination additive/subtractive manufacturing machines launched at the event – the company makes just the one model, the LaserTec 65 3D, 500 mm diameter part (X and Y) by 400 mm high capacity – there was a notable development. This model can now layer two dissimilar metals: the latest version offers two tanks for separate metal powders that the machine blows into the path of a 2.5 kW diode laser.

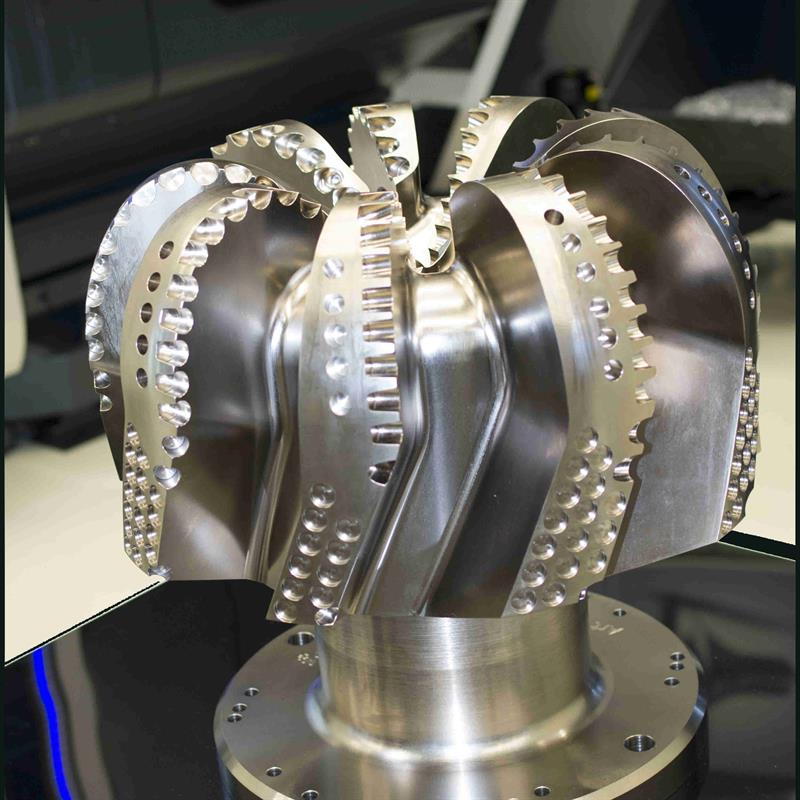

Machined drill bit: Using additive manufacturing to weld hard metal coatings onto soft alloys could save weeks of machining time

Machined drill bit: Using additive manufacturing to weld hard metal coatings onto soft alloys could save weeks of machining time

In the press briefing, Mori said that the unit’s ability to coat machined parts in 5-axis processes enables production of high value components, such as drill bits, in a fraction of the time it would take to machine them from hard metal (from four months to a week, he claims); instead, components are milled from relatively soft steels and then coated with a harder metal.

BOX: Other new machines

- The second-generation CTX gamma 3000 TC, the company’s largest lathe, offers a Z-axis stroke 150 mm longer than before – it is now 3,050 mm. Its compactMaster 2 milling spindle is 70 mm shorter than before to allow more head height, and offers 120% the torque, 220 Nm, though the standard main turning spindle torque is ten times that. ‘TC’ means tool change: instead of a turret it employs a chain-based toolchanger to hold up to 180 tools.

- The DMU 210 P second generation universal machining centre is said to be the “prelude to the new generation of portal machines”. What’s new is enhanced rigidity, cooling systems and an enlarged working area (2,100 by 2,100 by 1,250 mm in X, Y and Z).

- The DMU 600G linear is a double bridge-based machining centre for very large, very heavy parts (up to 150 tonne) where long travel is carried out by the gantry, not the workpiece (standard work area is 6,000 by 3,500 by 1,500 mm in X, Y and Z). A key focus is automotive mould and die applications.

This article was first published in the March 2016 issue of Machinery magazine.