Seizing on low interest rates, the two companies behind the DMG Mori machine brand – DMG Mori Seiki Co of Japan and DMG Mori Seiki AG of Germany – accelerated their plans to merge. DMG Mori Seki Co CEO Dr Masahiko Mori and DMG Mori Seiki AG CEO Dr Ruediger Kapitza presented plans for a voluntary share buyback programme at a press conference at the event. The programme could see the Japanese company take over the German one, which at the €27 per share now values the latter at €2.3 billion. The two companies already have cross shareholdings in each other.

An update on the status of the merger is expected by Easter.

"We have to face global challenges and look at the future. A lot of people talk about globalisation, but hardly anybody is truly global," says Kapitza.

In preparation for the new global structure, two new worldwide headquarters have opened in the last 12 months – in Winterthur, Switzerland, which has just reached full capacity, and in Tokyo. Both contain showrooms and training facilities.

As the two companies continue to merge into the world's largest machine tool maker over the next five years, the 200-odd models made in the 20 facilities of the group (12 in Europe, five in Japan, two in China and one in USA) will be rationalised to between 100-120. But more units of each will have to be produced; Mori says that the combined company's goal is to make 20,000 machines, nearly double the 11,000 it made last year, and about a third morethan what he says is the maximum currently possible with existing staff, 13,000-14,000. This will not need many more factories, but more staff in existing factories will be needed, he adds.

An example of globalisation is the NHX 4000/5000 horizontal machining centre series (capacity 400 by 400 by 900 mm, and 500 by 500 by 1,000 mm, in X, Y and Z), launched last year. These were designed in the DMG Mori Seiki Co factory in Davis, California, and are built both there and at the DMG Mori Seiki Co's factory in Iga, Japan, the traditional centre of expertise for lathes. In future they will be built in Tianjin, China, in Italy and even in Pfronten. Building locally helps reduce transport costs, explains Christian Thoenes, DMG Mori Seiki AG board member for product development, production and technology. It also reduces currency fluctuation effects.

COMMON CONTROL INTERFACE

Another example of globalisation is the group's CELOS common machine operating system for machines made by both companies, which sets out to bring the group's machine tools into Industry 4.0, the internet of things. "Drawings and communication will be replaced with digital data transfer. Machine tools should be able to fully use these digital data," Kapitza offers.

The theme is picked up by Mori: "The most important thing is connectivity." That strand is being developed by the US operation, while Japan – which has 200 developers of its own – progresses the CELOS software and machine inputs such as sensors, while the German and European operations develop the structure of the whole system and industry standards. All three centres are working together on CELOS development.

At the heart of the interface design is function selection via 'apps'. Four new apps will launch in April. These include a predictive maintenance tool that will schedule servicing automatically for customers, supporting maximum uptime (and help DMG Mori dealers obtain service revenue). A PC version of the software is also now available, to manage production on other machines. More apps are promised for the biennial EMO manufacturing technology show in October, in Italy, and others will follow annually.

Although full year sales figures are not available, Kapitza says the 2014 calendar year would be DMG Mori Seiki AG's best ever, achieving sales targets predicted in October 2014: sales of about €2.2 billion and EBIT profit of €175 million.

In contrast, global machine tool industry sales as a whole is expected to remain static in 2014 at €58.7 billion. The current year looks to be much better for the global industry, however: up 7% to €63 billion, with growth in the Americas, Europe and Asia counteracting a large fall in Russia.

But Kapitza is much more doubtful about his company's own prospects for 2015; he calls world markets 'volatile', owing to falling oil prices and currencies (the euro, the Swiss franc, and the Russian rouble), as well as the US and EU embargo on Russian goods. Russia is a particularly rich market for the company whose prospects – it appears – recent events have impacted. A long-planned new factory for entry-level ecoLine turning and milling machines in Ulyanovsk southeast of Moscow should help the company's sales in Russia when it opens in October.

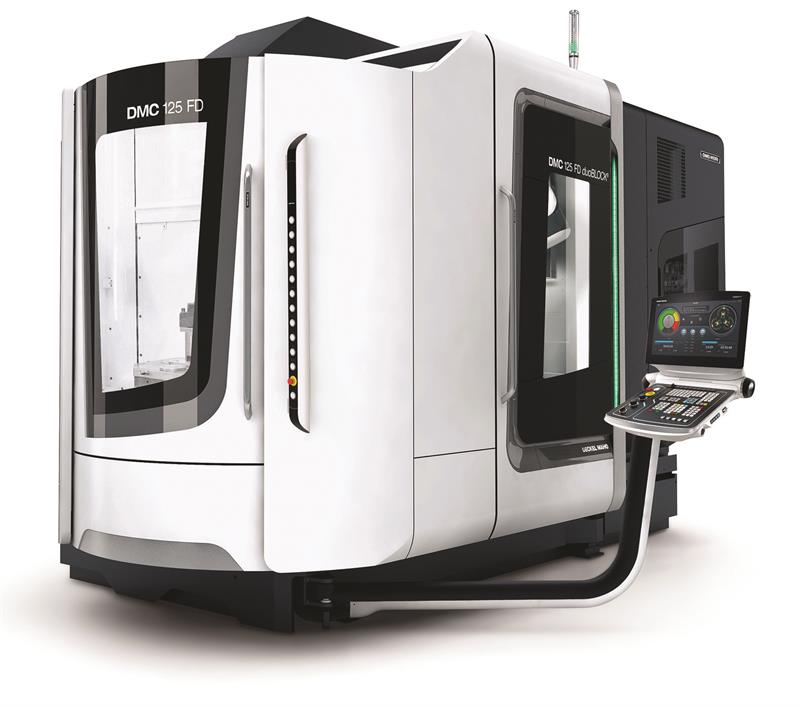

The DMC 125 FD duoBlock machine (fourth generation) boasts up to a 30% increase in machining accuracy, thanks to strengthened components and more extensive temperature management

Against this global backdrop, the company unveiled four worldwide launches: two fourth generation 5-axis machining centres (DMU 100 P duoBlock and DMC 125 FD duoBlock with 1,000 mm and 1,250 mm X-axis travel respectively and both with 2,000 kg load); a large-format portal machining centre (DMC 270 U with 2.7 m X-axis travel); and a new second generation turn-mill centre (CTX beta 1250 TC, 1,210 mm length and 500 mm swing capacity). There were also two European launches (after prior launches in Asia): the NZX 4000 4-axis turning centre for long workpieces and the double-spindle NRX 2000 turning centre.

In terms of technology development, several interesting new technologies were presented. One is ultrasonic-assisted milling: a new second generation technology is now suitable not only for grinding but also milling and drilling of materials such as carbon fibre reinforced plastic (CFRP), titanium, aluminium oxide, Zerodur, sodalite, agate and aventurine. The drill head, which receives the motion signal through inductive transfer, now has more than three times the amplitude, up to 10 micron, a shorter – and stiffer – actuator, and can even accommodate tools with a defined cutting edge.

Another technological priority is spindle development: at last year's event the compactMaster spindle was unveiled for the CTX beta 800 TC but now also features on the new CTX beta 1250. At or after EMO this year, a high torque spindle (up to 1,300 Nm) called 5X-torqueMaster for the new (fourth generation) duoBlock machining centres will be launched.

ADDITIVE DEMONSTRATION

A further highlight was a demonstration of its recent foray into additive manufacturing. Based on a DMG monoBlock machine, the Lasertec 65 AM model, launched at last year's event, combines a laser deposition process to build components from metal powder and 5-axis machining capabilities to mill those components into their final form in a single set-up (although the part does need to cool down first). Its build area is 102 mm diameter by 210 mm high, and the machine deposits a 3 mm wide by 1 mm high bead. Four of the €800,000 machines were sold in 2014, two for customers in Germany and two for firms in Japan.