According to the report, Vero Software has more than double the number of installed software licences of any other software vendor, representing more than 22% of global market share.

In addition, CIMdata estimated that Vero was again able to increase its market share, in terms of direct revenue, now representing a market share in excess of 10%, with further growth predicted for 2016.

Says Stan Przybylinski, CIMdata’s vice president of research: “Vero’s broad CAM portfolio helps the company maintain its market position. The range of solutions, while challenging to maintain and enhance, gives it stability when some industries may face challenges, and a large addressable market overall.”

Since 2014, Vero Software has been part of Hexagon AB, a Sweden-headquartered “global provider of design, measurement and visualisation technologies that enable customers to design, measure and position objects, and process and present data”. Hexagon AB is a €3 billion-plus turnover organisation (2015 figures).

Vero Software CAM system brands include: Alphacam; Cabinet Vision; Edgecam; Machining Strategist; PEPS; Radan; SMIRT; Surfcam; VISI, and WorkNC. The company also has production control MRP system Javelin within its software portfolio.

The CAM-focused organisation boasts offices in the UK, Germany, Italy, France, Japan, USA, Brazil, Netherlands, China, Korea, Spain and India, supplying products to more than 45 countries through its wholly-owned subsidiaries and a reseller network.

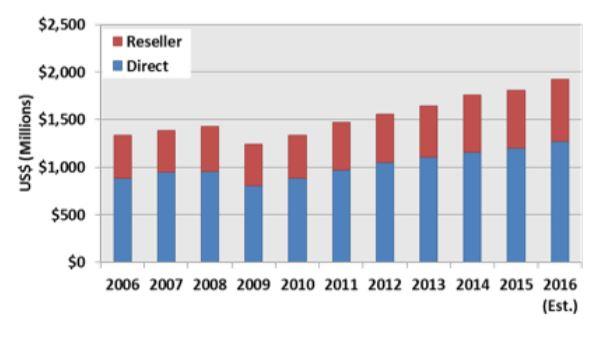

CIMdata projects that in 2016 end-user payments for CAM software will increase by 6.5% to $1.93 billion

Says Jeanne Naysmith, the leader of CIMdata’s manufacturing practice: “The CAM market had solid growth in 2015, but it will be interesting to watch the adoption rate of cloud-based CAM, an issue raised by many leading CAM solution providers during our annual survey. While there are obstacles for both buyers and sellers to realise the wide adoption of cloud-based CAM, CIMdata expects the use of cloud-based CAM software to grow at a rate faster than the overall CAM software market. This growth will come from new users drawn to the low-risk start-up value-proposition offered by a cloud-based application, and by cloud-based offerings supplanting existing desktop software whose users will likely be attracted to the operational flexibility enabled by cloud-based subscription models.”