This total figure was £1.9bn more than in Q3 2023, an increase of 1.2 per cent, the analysis found.

FourJaw’s analysis, which informs its UK Manufacturing Productivity Index, revealed that the value of output produced this summer was 1.2 per cent lower than Q2 2024.

Much of this was due to a 0.7 per cent decline in the price of goods leaving factories in September. Adjusting for price fluctuations shows that Q3 2024 production levels were broadly similar to Q2.

With more manufacturers operating today than in 2023, output per manufacturer was down 0.3 per cent year-on-year. However, this output came from 25,000 fewer workers, so output per manufacturing employee has increased by 2.2 per cent over the last year, FourJaw said.

Industry findings

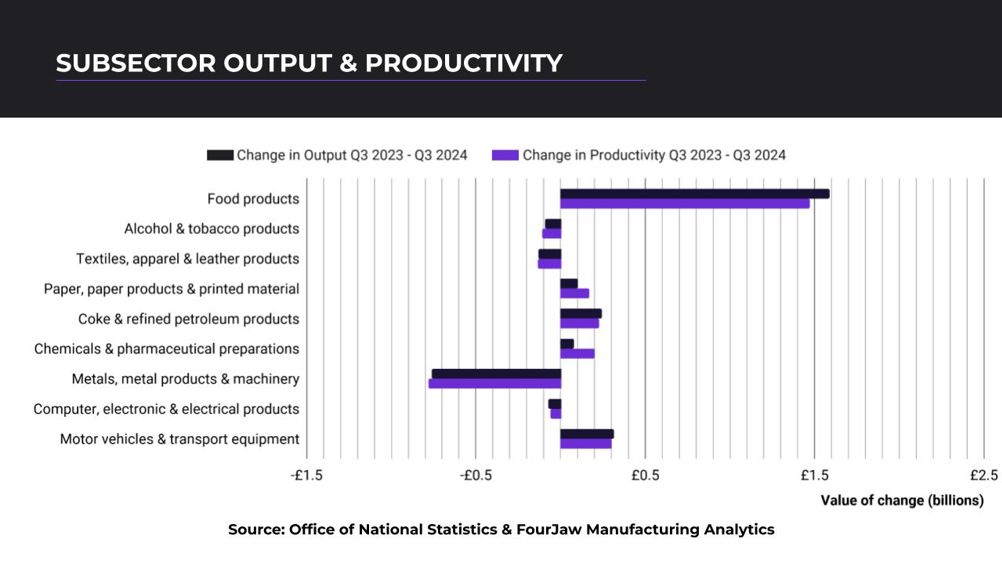

FourJaw’s analytics found that food manufacturing continued to pick up pace. The value of food production increased by 6.4 per cent year-on-year to £26.5bn in Q3 2024, in part due to productivity gains worth an estimated £1.5bn.

Coke and refined petroleum products declined by 1.2 per cent between Q2 and Q3 2024 but remained 10.0 per cent ahead of what the industry produced in Q3 2023. This sector is estimated to have achieved productivity gains worth £224m in the last year.

The output value from UK chemicals and pharmaceutical manufacturers was 0.8 per cent higher in Q3 2024 than in Q3 2023, despite significant downward pressure on prices over the last year. This sector is 2.0 per cent more productive than a year ago, improvements worth £197m, despite a 4.2 per cent quarter-on-quarter decline in output value during Q3.

Output in the motor vehicles and transport equipment industries increased by 1.1 per cent year-on-year, totalling £312bn in Q3 2024. However, this was 5.0 per cent down on Q2 2024.

Metals, metal products and machinery output in Q3 2024 was found to be down 6.3 per cent year-on-year, a decline of £758m.

In a statement, Chris Iveson, CEO at FourJaw Manufacturing Analytics, said: “The latest manufacturing data has some aspects to be proud of. Manufacturing output and productivity are up compared to last year despite global economic uncertainty and businesses delaying investment decisions pending the general election.

“There are more manufacturers in the UK than a year ago, and while they would like to be busier, data indicates the industry is leaner and more efficient, producing more with a smaller workforce.”

More from Policy and Business