Kyocera acquired SGS Carbide Tool UK, the maker of solid carbide drills, end-mills and routers, five years after acquiring another tooling company, Denmark’s Unimerco, and forming Kyocera Unimerco. Although sharing a common parent, the latter’s sales and operations in Lichfield (Staffordshire) and Sheffield are not linked to the former’s Wokingham activity.

At a January aerospace-themed event in Wokingham, the University of Sheffield Advanced Manufacturing Research Centre with Boeing, of which the tooling firm is a Tier 1 member, was an invited speaker. AMRC’s machining group head of applications, James Needham, explained how the evolving performance requirements of aeroengines are driving the use of nickel-based heat-resistant superalloys (HRSAs). Air travellers want reliability, which involves a high quality, certified and tested material; and low ticket cost, which is driven by fuel consumption, supported by tight tolerancing of components, and leaner burning engines (that in turn require combustion at higher temperatures).

Hotter-burning engines require equally-impervious materials; HRSAs offer a hot hardness (up to 400 HB in annealed condition) equal to the task. And the same characteristics that earn their keep in an aeroengine (and 50% of an aeroengine by weight is now nickel alloy, Needham states) make them equally hard to machine. This, he points out, only slightly tongue in cheek, is good news for cutting tool manufacturers.

As the trend for more extreme operating conditions in aeroengines shows no sign of abating, design engineers will continue to search for ever-more exotic alloys. These new materials will be more difficult to machine than current materials; it is unclear how far this development can go. Will the supply chain continue to be able to machine these materials at a rate or price that is cost-effective for the end user? Exaggerating to make the point, Needham argues that if engine components were to be specified from some impossible-to-machine material, such as the mythical kryptonite from the Superman comic, the engine’s fantastic theoretical performance is worthless, since it cannot be produced. Needham predicts that the issue will probably be decided on cost, and that manufacturers and the supply chain will be squeezed on that.

Alan Pearce, Kyocera SGS president and CEO, chats with visitors

Fortunately, the AMRC, with its members in the supply chain, continues to investigate technologies that reduce the cost of manufacture. These kinds of development partnerships are vital to the future of the industry, said Alan Pearce, Kyocera SGS president and CEO, at the event. Addressing the seminar audience, he said: “I’m very passionate about collaboration. Really, working with the AMRC and [other] Catapult centres, working with our partners who are here today is crucial. We’re in difficult, challenging times now in the UK, but now is [also] a great opportunity that we’ve never really had, particularly in terms of export. I encourage you to think about working in collaboration with partners a lot more to optimise the processes that you do now, because if you don’t do that, and take that seriously, how are we [as an industry] going to be competitive?”

To further its own collaboration capabilities, Kyocera SGS’ US tool manufacturing operation last year announced plans to build a $9.5 million Tech Hub in Danville, Virginia, that is to house co-production spaces for it and partners to “realise repeatable subtractive processes,” the company said. Back in the UK, the Wokingham facility houses a prove-out centre for in-house trials, process optimisation, machining strategies and time studies using a Grob (0121 366 9848) G350 5-axis horizontal machining centre with A/B-axis table (600 by 855 by 805 mm in X, Y and Z), fitted with a 35 kW HSK-63 spindle having through-coolant.

The other partners supporting the event were the West of England Aerospace Forum (WEAF); Alicona metrology equipment (01732 746670); CADCAM software Edgecam (Vero Software; 01242 542040); NC programmers LMg Solutions (01656 668 806); MST toolholding and Showa Tool (both distributed by Kyocera SGS); CAM software Vericut (CGTech, 01273 773538) and Wogaard, a supplier of coolant recycling systems (0843 2893570).

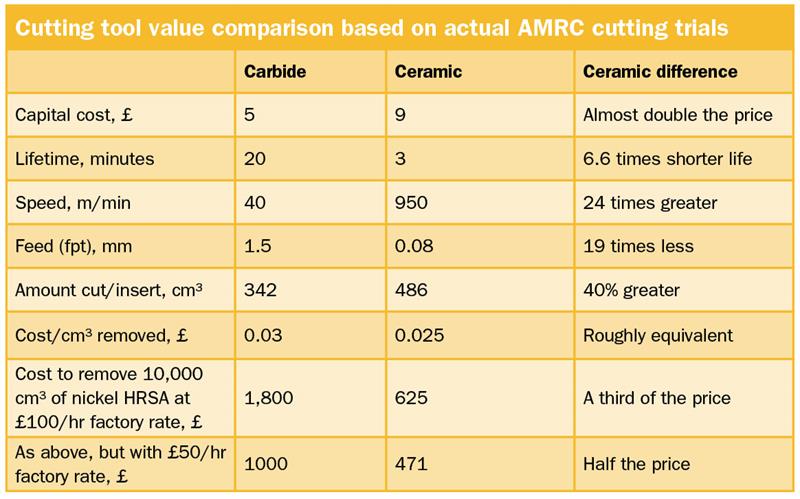

In an example of an AMRC-industry partnership, Needham described a popular metalcutting production cost/benefit analysis that it carries out, based on machining trials (see table below). Although this particular example involved cutting tools, he pointed out that it could have focused on any part of a machining process.

The analysis compared the costs and performance of carbide and ceramic cutting tool inserts. It found that a comparison of cutting tool cost based on limited production information yields a very different result to one that includes elements of the wider context. The figures are real, but Needham did not disclose the tooling brand(s) involved; he did say, though, that they represented typical levels of performance.

A step-by-step comparison of the cost of carbide versus ceramic tooling demonstrates the importance of the production context. Based only on a few factors (price and lifetime), carbide is the clear winner. Once other production data (cutting performance and factory overheads) are included, the better value of ceramic inserts becomes clear

Needham adds that there are many reasons that prevent people from considering all of the factors involved in the costs of machining. Common blockers include mindset, production legacy, degree of purchasing sophistication, machining capability and tooling availability.

He concludes: “There is a long list of reasons not to do something. But if we don’t do it, if we aren’t looking ahead, it leaves us only one thing to compete on: hourly rate. If we don’t want to compete on hourly rates, and that’s not the future for the UK, we have to be doing something differently. Thinking about the overall value that a solution presents is a better way to think than short-term purchasing.”

EXTENDED FEATURE FROM HERE

TEXT BOX

On the shopfloor

A factory tour followed the seminar. Monthly production volume of the Wokingham facility is about 6,000 units, consisting of batches of from one to 1,000 of tools, from 0.5 to 65 mm diameter, mostly of solid tungsten carbide. They are produced in 24 hr/6 day operation. The site employs 50 people.

Ian Holliday, manufacturing manager, explains that although standard products are made in the USA (in vastly greater quantities of 10,000 per month), all UK production is dedicated to specials or premium products. The facility also performs modifications to standard products and carries out regrinds, too.

Opened in 2013 with nine Walter (01926 485047) tool grinding machines, the site’s production capabilities have since expanded. Other specialised production machines now on the shopfloor include:

- Rollomatic (07949 120431) Trutech Revolution profile grinder (tools sit in roller; grinding runout said to be less than 1 micron)

- Walter 3D Helicheck inspection machine (featuring automated load/unload; automatic ultrasonic washing; laser measurement of flute shapes)

- Two Alicona (01732 746670) Edgemaster machines; one measures edge hone; another is used to inspect surface finish on coated tools

- Action Super Abrasive (01922 694 692) semi-automatic ASA250 wheel dressing machine. As skilled labour is at a premium, the company started an initiative last year to reduce machine setting times, cutting them by half over the course of 2016. Holliday states: “The key reason for that is the wheel dressing machine.”

The Kyocera Hardcoating Technologies Europe facility next door, which services the factory and outside clients, offers four physical vapour deposition (PVD) coatings using a CemeCon CC800/9 machine. They are titanium diboride (TiB2), an AlTiN coating called SuperAlt, and two high power impulse magnetron sputtering (HiPims) coatings – a general-purpose HiPulse Power coating and HiPulse Hard for heat-treated metals.

This article was published in the March 2017 issue of Machinery magazine.