The Manufacturing Technologies Association (MTA), organiser of the MACH exhibition, reports that the 2014 event led to £177 million of business for manufacturing technology suppliers exhibiting. Hopes are running high for this year’s event.

And the prospects look good: according to a recent Attitudes to Business Investment survey from Lombard (0800 502 402), said to be the UK’s largest asset finance provider, nine out of 10 manufacturers are looking to invest to improve productivity this year.

Perhaps an underappreciated, but essential, element of these sales is the credit used to buy them. For example, two-thirds of the Doosan machine tools sold by Mills CNC involve its financing business, says Ian Barber, manager, Mills CNC Finance (01926 736736); and the real figure may be higher, since there’s no telling whether the rest of the customers who paid with cash haven’t taken out a loan with another third party, he adds. In this market, hire-purchase – in which the customer ends up owning the machines – is much more popular than renting through leasing; Barber estimates the ratio is 85:15 in favour of hire-purchase.

Now happens to be a good time to finance a new asset, says Andrew Bullard, managing director of ETG Finance, a subsidiary of the Engineering Technology Group (01926 818418), suppliers of Hardinge, Micron, Nakamura-Tome, Stama, Handtmann and Quaser machines. He offers: “The recession was horrendous. Now, customers have never had it so good. There are so many lenders available that are willing to lend on attractive terms and rates, it’s unbelievable.”

A BUYER’S MARKET

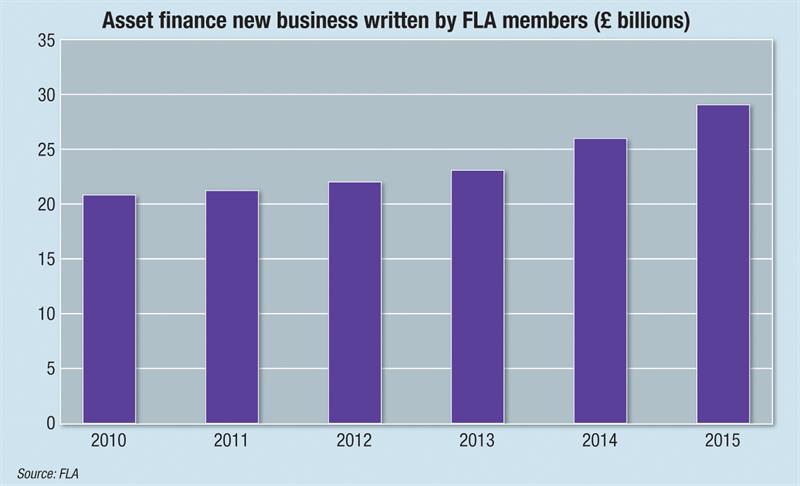

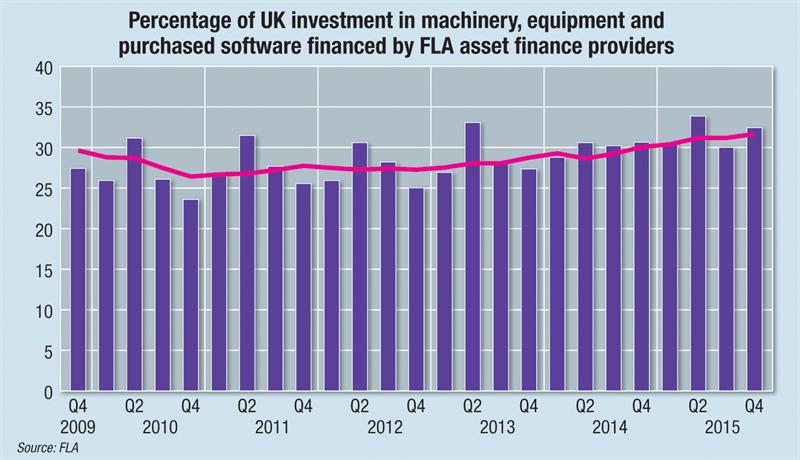

Figures from trade body the Finance & Leasing Association (FLA) back up Bullard’s point about the wide availability of finance. Growth in asset finance new business (primarily leasing and hire purchase) was 12% in full year 2015 – the market’s second consecutive year of double-digit growth – reaching new business levels of more than £29 billion. The sub-category of plant and machinery finance grew by 7% in the same period to reach £5.8 billion, making it the third largest segment by value, behind business car and commercial vehicle finance. The FLA estimates that its members financed almost 32% of UK investment in machinery, equipment and purchased software in the UK in 2015.

There may be several reasons why the market is so active. First, low interest rates set by the Bank of England help keep the cost of borrowing low, attracting custom. Second, although some banks stopped offering loans during the recession, they returned when the economy rallied, with other lenders attracted by news that the recovery was manufacturing-led. Third, the recent drop in the oil price has reduced investment by oil and gas suppliers, shrinking the size of the machine market.

So: where to go? In addition to companies contributing to this article, MACH sponsor Lloyds Bank Commercial Banking (0800 056 0056; MACH stand 4572) offers trade finance, loans, asset finance and more for business by size class: microbusiness (up to £1 million turnover), small businesses (£1-25 million) and medium and large businesses (£25 million plus). Merchant bank Close Brothers (020 8339 4949, stand 5450) offers asset finance, including hire purchase, leasing, refinancing, as well as other lending services.

Small businesses may have access to other options, including regional community lenders. For example, Wolverhampton-based BCRS Business Finance serves small businesses in the West Midlands, as well as supporting lending indirectly. Last month, it helped set up a three-year, £300,000 Stoke-on-Trent Business Loan fund for small firms there. BCRS is a member of a nationwide group called Responsible Finance, formerly known as the Community Development Finance Association.

Its 50-odd members that loaned £251 million to 57,800 customers in 2015 are said to offer “fair and affordable” loans. Most of them focus on a particular region, but they all have to sign up to a code of practice. Members can be found on www.findingfinance.org.uk.

One of the ‘banks’ that wants to see increased lending to small- and medium-sized businesses across all sectors (not just manufacturing) is the UK government. Concerned that small businesses are having a hard time acquiring funding for growth, the British Business Bank (BBB), a wholly owned government body, has since October 2015 offered funds to business lenders: £100 million to Hitachi Capital (UK) and £51 million to LDF – 50% of both were backed by the European Investment Bank – and £25 million to Haydock Finance. All are part of BBB’s Enable programme that aims to increase the supply of leasing and asset finance to smaller UK businesses. More such contracts are likely in the next 12 months, the organisation says.

Of the discounted financing, Andrew Davies, sales manager of LDF (01244 527300) says: “The BBB line enables us to get different rates and different options for some clients. Because there’s more money, [our offering] can be more competitive.” Although LDF also has access to a £75 million line from Investec, as well as brokerage relationships with several other funders, Davies admits that the BBB line would often give the best rate, all else being equal, although, of course, circumstances vary. A typical loan amount is £100,000 or above, although smaller amounts may be agreed.

SPECIALISTS FOR MANUFACTURING

Rather than go to a bank, customers are being advised by Siemens Financial Services (01753 434168) to choose a funder or a broker more familiar with manufacturing.

It says: “While generalist financiers simply tend to supply finance, specialist asset financiers, especially those with an industrial background and close links with professional associations, tend to have a more in-depth understanding of the technology, machinery and equipment, as well as the business models, benefits and risks involved. They are therefore more capable of crafting financing arrangements that fit the end-user’s particular circumstances and cash flow needs.” It suggests that customers work with lenders that have joined the FLA, as it has; they are required to sign up to a 2011 code of conduct (currently under revision).

Access to funding for a new purchase might depend on how many barriers are put up during the lending application process. For example, Siemens Financial Services recommends machinery buyers consider asset finance contracts in particular, because it says that they are more flexible than traditional bank finance’s “very rigid criteria for loans”.

But LDF says that the trouble for some small companies is the limited nature of an asset financing contract; while the ‘metal box’ itself may be eminently financeable, funding softer assets surrounding its implementation, such as R&D, may prove much harder, particularly if businesses cannot meet every requirement on the application form. Says Davies: “For software or intangible assets that didn’t fit into the traditional model, that’s where we are seeing people having difficulty.”

INTANGIBLE ASSET INITIATIVE

That issue is getting recognition at higher levels. In November 2015, FLA and the MTA proposed that a new finance support scheme be set up to facilitate funding of intangible assets; it proposed that government underwrite a “modest part of the risk, as already happens in other markets.”

As to hardware, though, ETG Finance managing director Andrew Bullard says that he has never been unable to procure finance for machine tools: “There’s always a way to do a deal.” This is so even when one in five buyers has credit issues, he adds. Customers with bounced payments, debts or losses over the last year, or a limited trading history might need to include a director’s personal guarantee, security on another machine, and/or pay higher rates.

ETG and Mills, among others, act as brokers calling on a range of different types of funders with different risk appetites, from financiers that are extremely strict, but offer good rates, to ones that are more accommodating. Barber at Mills puts it like this: “We also work with Tier 2 funders that charge more but have a wider commercial view about who they want to fund. If they are taking a riskier lending profile, they’ll charge more. There isn’t one funder in the marketplace that covers the whole spectrum; all have a specific niche.”

Also, ETG Finance will provide customers with several quotes from different sources to help get customers a good deal. And it can arrange to delay the start of repayments on a new machine tool until it is up and running and – most importantly – earning. While it can’t offer part exchange, it will help customers find a buyer for their old machine tool. These, says Bullard, are some of the advantages of going with a financier attached to a machine tool vendor; not only does it have access to the right contacts in the lending marketplace, but also it is a one-stop shop, offering both machine tools and financing.

BOX

Another way: equipment leasing

There are two general types of equipment leasing contracts, according to Siemens Financial Services: finance and operating. Through a finance lease, the financier purchases and owns the assets, and then leases it to the company. During the agreed term, the cost of the equipment, interest and charges are paid by the customer via regular payments.

In contrast, an operating lease does not last for the full economic life of a piece of equipment. In this sense, an operating lease allows for use of an asset without transferring all of the risks of ownership to the lessee. The equipment is therefore rendered more affordable as the customer is not required to finance the full cost of the asset. However, leasing periods tend to be shorter.

Mills CNC, for one, offers a 12-month ‘Smart Rental’ lease, which was particularly popular during the recession. Says Ian Barber, manager of Mills CNC Finance: “We would hope that most of those machines will stick, although it does give customers a bit of a break to hand the machine back, if things don’t pan out.”

BOX

Financing for software

As asset finance providers may not be willing to fund companies’ purchase of CADCAM or other software (see main text), these increasingly essential packages have had to be funded in other ways, such as out of monthly cashflow.

However, purchasing software to go with a new machine tool may be getting easier.

Following a trend established by the consumer software marketplace (Microsoft’s Office productivity suite, for example) engineering software providers are moving away from perpetual licences and toward time-limited subscription models for buying software.

At the end of January, the last perpetual licences for Autodesk products AutoCAD, HSMWorks, Autodesk Inventor, among others, were sold; perpetual licences for some design suite software will be sold until July. They are being replaced by subscriptions: £1,480; £1,970; and £1,510, respectively, per year, although monthly subscriptions are available, too (www.autodesk.com/subscription).

Autodesk says that the ways that companies and individuals buy and access software is being affected by changes in the way products are designed and built. It adds: “By subscribing, you receive a simplified customer experience, lower upfront cost and the ability to pay for Autodesk products and cloud services for the amount of time that is right for you.”

Another software vendor offering subscriptions is CAM software Edgecam; its TestDrive package (www.edgecam.com/testdrive) enables users to create CNC programs for simple prismatic shapes in either a milling or turning context for £995 per year plus at least one day’s training for £395.

The subscription includes loading of solid file formats (such as SolidWorks or Inventor), Edgecam Workflow Solids, stock management, fixture management, advanced feature recognition, Waveform milling/turning strategies, machining cycles, automatic fixture avoidance of toolpaths, shopfloor documentation, TestDrive post-processor and NC editor.

This article was originally published in the April 2016 issue of Machinery magazine.