Built on the Advanced Manufacturing Park between Sheffield and Rotherham and uphill of elder sibling the Advanced Manufacturing Research Centre with Boeing, the Nuclear AMRC employs 80 people in a super-sized shopfloor and offices tucked under its eaves. Since 2009, it has been open to all UK companies to help them win work. Research projects typically last 3-4 months but, large or small, they start with the same scoping exercise, are taken from start to end by a project manager, with the assistance of a technical lead as well.

Says operations director Stuart Dawson: "We are a real hybrid between academia and industry. We have both big-brained creative academics and practical and experienced industrialists that provide realism, plus professional project managers. And the emphasis is on delivering projects to industry timescales; there is no linkage to academic outputs."

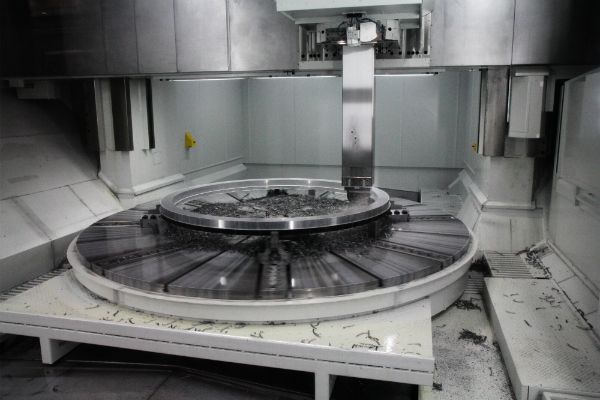

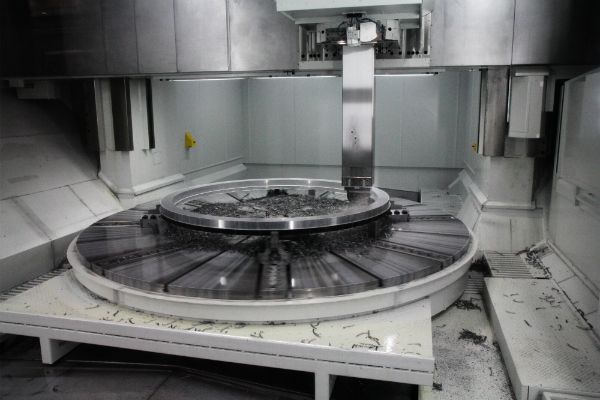

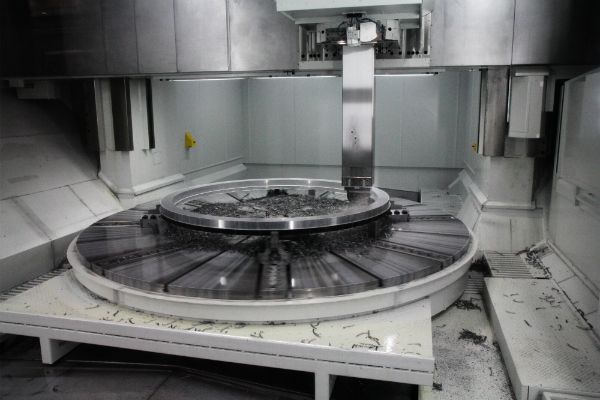

The centre's £26 million collection of machine tools and welding equipment may be the best at any research facility in the world. Late last year the organisation installed a Dörries Scharmann vertical turning/milling lathe with 5 m swing and 3 m working height (supplied by Starrag UK 0121 359 3637) and a Soraluce FX12000 horizontal milling centre with 12,000 X-axis travel (supplied by TW Ward CNC Machinery, 0114 276 5411). And as at Machinery's late November visit, finishing touches were being put to a temperature-controlled factory extension within which resides a Hexagon DEA Delta CMM (01952 681300) with a 6,300 by 3,000 by 2,000 mm working envelope (X, Y, Z). Parts up to 15 tonne will be measured here, having been 'floated in' on an air table. Already installed, welding capacity includes an electron-beam welding chamber capable of 100 mm thick welds (Pro-beam, +49 89 899 233-0), a 15 kW cell for diode laser cladding (Laser Lines, 01295 672500), arc welding equipment and more.

The Soraluce FX12000 is now the largest machining centre at the Nuclear AMRC

The Soraluce FX12000 is now the largest machining centre at the Nuclear AMRC

"Unless people have been to our facility, they might not understand that we are not a university lab; we can do a full-scale prototype in its actual material," says business development director Stuart Harrison.

Part of the Nuclear AMRC's mission is help UK businesses reach the very high nuclear standards, both in terms of actual metalcutting and also the stringent paperwork trail (see below). The difficulty of working in the nuclear industry, compared even to other high hazard industries such as oil and gas, is so well known that it has its own term, the 'nuclear delta.'

For example, irradiation during the working life of a steel component in a nuclear power plant tends to make it brittle; as a result, components for duty in nuclear environments start life as ductile as possible. "There are big machinability issues with high ductility steels," Dawson highlights.

By this he means that ductile materials tend to work harden when machined, with this tending to dull cutting edges. To reduce this problem, the Nuclear AMRC is looking at different tooling geometries, cutting parameters and machining strategies, explains production engineer Andrew Wright, who offers that ductile materials tend not to break off into small chips when cut. This is a particular problem in deep-hole drilling, he advises, where a long piece of swarf could jam in the drill bit, locking the bit in the hole and causing the tool to break.

There are other challenges in the deep-hole drilling area, too. Producing holes in tubesheets, common for heat exchangers in the nuclear industry, is a particularly demanding application, and is often achieved by using a dedicated deep-hole drilling machine. In an effort to use less specialised equipment, the Nuclear AMRC has undertaken trials on its Starrag HEC 1800 large format horizontal machining centre for heavy duty milling and boring. It has successfully bored holes of from 13-25 mm diameter to a depth of more than 500 mm in specialist alloys. The key factor in its success has been the machine's high pressure (160 bar) coolant system that breaks up the swarf.

The organisation is pushing that envelope even farther with its new Dörries VTL, which has the highest pressure coolant at the Nuclear AMRC site – 350 bar. The machine will be used for the turning of stainless steel and nickel alloys. Because of the ductility of the materials, machining operations for large components are periodically interrupted to crane out the balls of swarf that accumulate, because the material will not chip. High pressure coolant directed to the cutting edge will prevent this situation by breaking the chip and speeding up production. Studying how the metal chips helps researchers understand whether they are in safe territory.

The Dörries VTL machining a ring sample. Maximum workpiece diameter is 5 m

The Dörries VTL machining a ring sample. Maximum workpiece diameter is 5 m

"Productivity is great, but if you are right on the knife edge of scrapping the part, it is a false economy. Productivity with security is what we're about here," Wright underlines.

This is echoed by Dawson, who says that the nuclear power industry has a big focus on process security – right first time – in contrast to aerospace's greater emphasis on reducing cost and cycle time, partly because of the risk that it might have a knock-on effect somewhere else.

Another area of investigation has been complex turning operations, such as contour boring or large flange work, using facing head attachments on horizontal machining centres. The Nuclear AMRC now has two such machining units for this undertaking, including the just installed Soraluce FX12000, now its largest machine.

Wright says that, like deep-hole drilling, facing head work is a black art, a highly skilled operation. "We don't want to deskill it, but we need to try to minimise risk, so that we are less reliant on highly skilled operators, who are becoming harder to find."

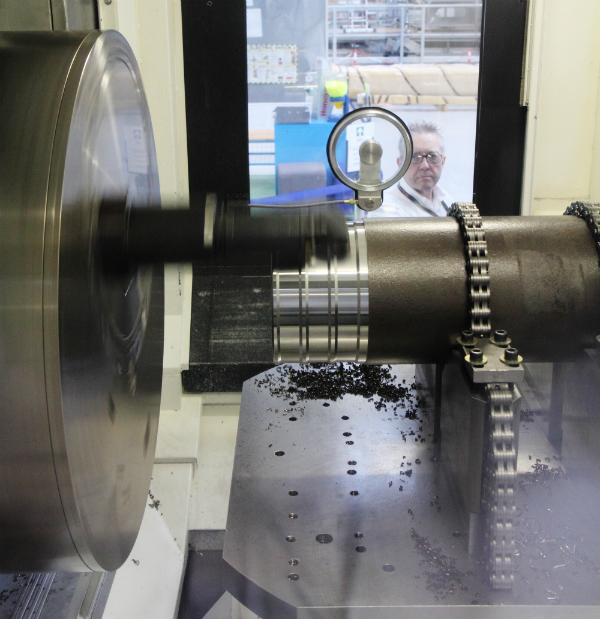

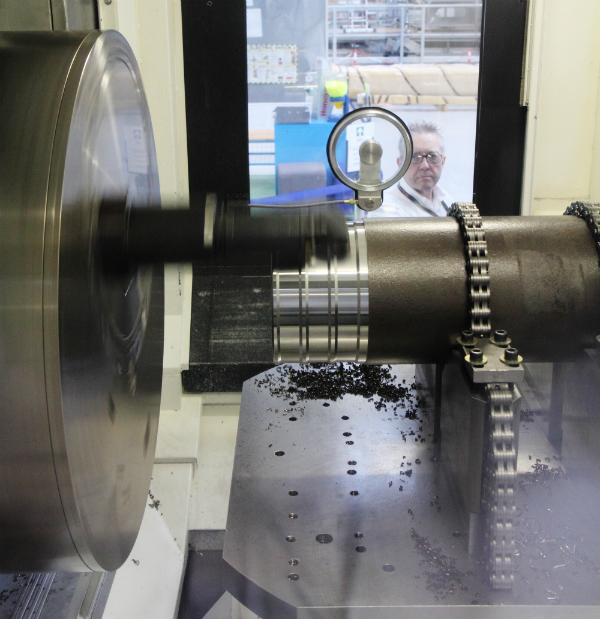

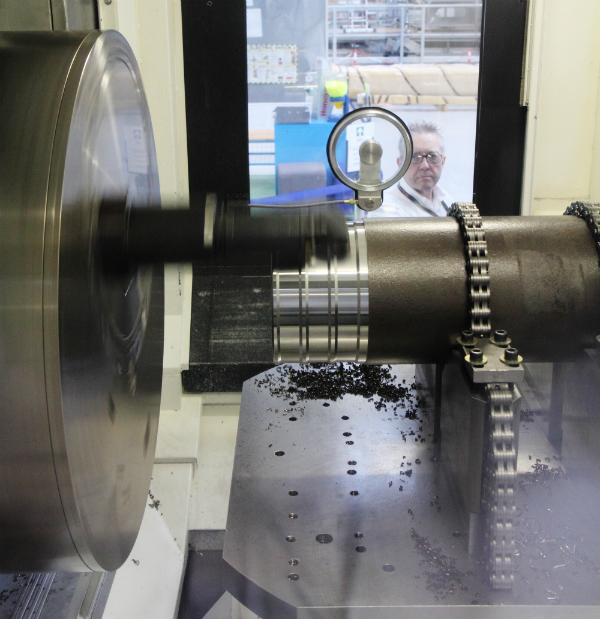

The Soraluce joins the organisation's Mazak Orbitec 20 (01905 755 755), which was the first machine of its kind in Europe at installation. The Mazak machining centre can generate turned features up to 508 mm diameter, even if they are off-centre, while keeping the workpiece stationary. In similar vein, the Soraluce FX12000 travelling-column horizontal machining centre can use its D'Andrea facing head to perform turning operations. "With large gearbox casings, you can do milling, then pick up the facing tool and then do complex contour boring work without having to take the part off the machine tool, thus reducing set-up time," Wright points out.

Mazak Orbitec working at the Nuclear AMRC

Mazak Orbitec working at the Nuclear AMRC

In mid-November, the Nuclear AMRC was waiting for installation of working platforms for the Soraluce to make the machine factory-ready, but later this year it is scheduled to work on a 35 tonne component (its table has a 65 tonne capacity) measuring 4.5 m in diameter and 1.5 m high – the component, customer and work being done are all confidential, however.

OPPORTUNITY FOR PROCESS INNOVATION

But scope for machining process innovation for nuclear energy parts can be limited. Says Dawson: "As regards innovation in the nuclear industry, some routes are open and some are closed. On existing generation-III+ nuclear new build there is very little scope for anything truly innovative. The safety case has already been made and manufacturers have to comply with it. There is a potential opportunity with decommissioning, although the market is still conservative." The centre is looking beyond these limitations at an emerging area. A big new project for Nuclear AMRC is a development agreement with US startup NuScale that is designing a new type of small modular nuclear reactor (SMR) that is a fraction of the size, power, and cost of conventional nuclear power plants.

"There is a real opportunity in getting something innovative adopted in SMRs because the designs have not yet gone through a safety case; the manufacturing process might as well be radical," Dawson offers.

"SMRs' economic model hinges on factory manufacturing, rather than on-site construction, and also on significantly higher manufactured volumes – up to dozens per year," he says. This will help drive efficiencies of scale through volume and repeated learning opportunities.

Concludes Dawson: "In addition, there are several new manufacturing technologies: electron-beam welding and diode laser-based cladding. These could transform the economics of manufacturing in terms of time and cost. We have the chance to shape the future manufacturing agenda in SMRs. Also, unlike gigawatt-scale reactors, a pre-existing overseas supply chain doesn't yet exist. We can be competitive and not get locked out. The UK has a real opportunity here."

BOX: Supply chain engagement effort

Nuclear AMRC business development manager Stuart Harrison says that, in his experience, newcomers to nuclear need to make sure that their understanding of safety culture and human performance is sufficient. "The nuclear industry is looking for a strong learning culture. Having an audit trail is important. One supplier said to us 'there is more paperwork than metalwork'. That's true, and for good reason: the components have to last for 60 years or more."

To help gauge the readiness of UK manufacturers, Nuclear AMRC developed with the nuclear industry an online diagnostic tool called

Fit 4 Nuclear. It aims to show businesses their areas of weakness in bidding for nuclear work, and helps them develop action plans. Since its start in July 2011, 150 companies have gone through it. The scheme received a new lease of life in September 2014 when the Manufacturing Advice Service (MAS) came on board to coordinate and project-manage it with delivery partners Grant Thornton. Also, it is taking the process a step farther: Regional Growth Fund grants of up to £10,000 (which need to be matched by the company) are now available to the first 145 English small to medium-size companies who want to take the next step.

BOX: What's happening with nuclear new-build?

After years of delays, the nearest nuclear new-build project, to build two European Pressurised Reactor at Hinkley Point B in Somerset, has finally reached the point of 'final investment decision' by customer and architect-engineer EDF Energy. It is now finalising arrangements with investors; if given the go ahead, it aims to complete construction and commissioning by 2023.

In a separate move, in mid-2014, Toshiba completed the purchase of a controlling stake in the NuGen project for nuclear new-build adjacent to the Sellafield nuclear site in Cumbria, with electricity utility partner GDF Suez. The NuGen reactor design, of subsidiary Westinghouse, has not yet completed the UK regulatory review process, but it is already a long way down it. Three units are planned for the site, called Moorside. In December, NuGen said it is planning to make a final investment decision in 2018, with the first unit to be completed in 2024.

Finally, Hitachi's reactor design is now more than a year into a roughly four-year process of review by the UK regulator. In 2012, it bought Horizon Nuclear Power, which has land at existing nuclear power plant sites in Wylfa, Anglesey and Oldbury, Gloucestershire. It has started public consultations, with an eye on starting nuclear construction in 2019.

BOX: Some More Research about SMRs

Unlike modern commercial nuclear reactors, which require huge amounts of piping connecting various tanks and pressure vessels, small modular reactors (SMRs) are self-contained. Their main vessel generally includes the reactor core, with fuel and emergency control rods, and steam generator, but not the turbines nor stores of emergency cooling water.

The reactor vessel is designed to be small enough to be shipped by rail in one piece, and therefore small enough to be built in a factory. That should mean, once the manufacturing programme is worked out, it can be constructed more quickly and cheaply than current commercial nuclear reactors, which rely heavily on huge complements of construction workers.

Their size also allows multiple reactors to be set up at a single site to to create a larger power plant; this is what is meant by the word 'modular'.

SMRs could be used for standard commercial power, particularly where electricity grids are too small to carry gigawatts of power, or for remote locations where there are no grids, because they produce a tenth or less of the power of a conventional commercial nuclear power plant. They are also a fraction of the upfront cost of the larger plants, which is a key commercial advantage.

Small reactors have been around since the 1960s, and continue to power nuclear submarines and some aircraft carriers. Some designs use more advanced technology than others. SMR designs are being developed in the USA, Argentina, Europe, Russia, South Korea, China and Japan, at least. SMR development so far has been mainly government-lead.

The UK's National Nuclear Laboratory published a

favourable position paper on SMRs in December.