Last year, electricity utility EDF Energy, with minority partner China General Nuclear Corp, decided to start construction of the Hinkley Point C nuclear power plant in Somerset, the first in the UK in 20 years (since Sizewell B in Suffolk, also operated by EDF Energy). First electricity from the power plant is due in 2025.

EDF Energy compares the sheer volume of work involved in building a two-unit nuclear power plant offering 3,200 MW generating capacity as comparable in scale to the 2012 London Olympic Games.

UK businesses are set to capture 64% of the £18 billion project, said Greg Clark, secretary of the UK Department of Business, Energy & Industrial Strategy, when the government gave its blessing last year.

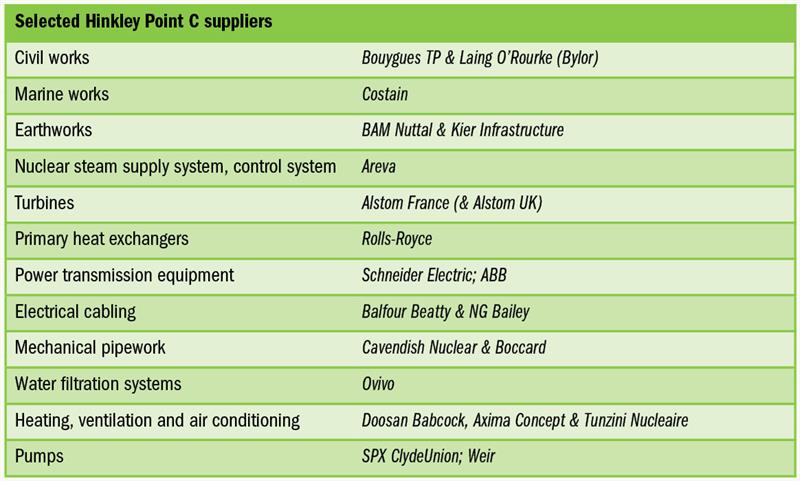

EDF Energy will have around 80 manufacturing-related contracts of their own to place. It says that key supply partners (Areva, Bylor, Costain and Alstom – see table) “will need to let many sub-contracts for manufacturing work”, including, it adds later, heat exchangers, pumps, valves, pipes, cable tags, fixings and cables. A complete list of work packages is available at http://www.hinkleysupplychain.co.uk/work-packages.

Many suppliers have already connected with EDF or one of its Tier 1s. By 2015, more than 1,700 companies had registered an interest on its national registration system (http://www.hinkleysupplychain.co.uk).

On EDF Energy’s web page for potential new suppliers for new-build nuclear power (https://is.gd/mihite) is a 20-page guide, entitled ‘Building our industrial future: Hinkley Point C supply chain’. The booklet aims to introduce potential suppliers to the idiosyncracies of civil nuclear power, since “the detailed verification and quality control required for components that will go into a nuclear power station are unique”.

In particular, EDF Energy requires oversight all the way down the supply chain. Qualified suppliers will be required to have “very strong” controls on safety, quality, schedule and costs in the sub-tiers of the supply chain, including testing and inspection plans, operate a “robust” non-conformance, deviation and concession processes “with full traceability and processes” to inform the ultimate customer. They should document and certify production during manufacture, should expect third-party checking and inspections, and they and sub-suppliers, should expect their quality management systems to be assessed.

Inexperienced suppliers interested in preparing themselves to bid for nuclear power might consider the Nuclear AMRC’s Fit4Nuclear corporate improvement programme (www.namrc.co.uk/services/f4n) that enables companies to measure their operations against the standards required to supply the nuclear industry and take the necessary steps to close any gaps. More targeted training can also be had from the National Skills Academy Nuclear Manufacturing, based at the Nuclear AMRC Training Centre in Rotherham (https://www.nsan.co.uk).

The time may be right to get into nuclear. EDF Energy hopes that this plant will be just the start of a new wave of nuclear power in the UK; it is planning to build a similar plant at Sizewell, Suffolk, and there are other nuclear power plant plans in the North West (Nugen’s Moorside project, near Sellafield); Gloucester and north Wales (Horizon Nuclear Power) and Bradwell, Essex (EDF and CGN again, but with a different plant design).

This article was published in the energy sector supplement of the February 2017 issue of Machinery magazine.