Reshoring got top billing a couple of years ago when Prime Minister of the day David Cameron launched a government-backed reshoring initiative. This saw UK Trade & Investment and the Manufacturing Advisory Service (MAS) form ‘Reshore UK’ (https://is.gd/dizale). That was January 2014 and the initiative is no longer; just like MAS. Today we have ‘Growth Hubs’ and local enterprise partnerships (LEPs), but a search for ‘reshoring’ at the LEP network website (https://is.gd/zehipa) delivers no related returns.

So it is left to small trade association the GTMA and its ‘Reshoring UK’ initiative to spearhead the effort at grassroots level, at least in the engineering sector. The organisation is working with nine trade associations and two high value manufacturing catapults (https://is.gd/rujinu) as it maps the UK engineering supply chain in total, not just the auto sector, making that information available via an online resource (https://is.gd/hisuho) – there is, literally, a map of suppliers at this resource, together with extra details for some. The effort is supported by design and manufacturing software giant Autodesk (www.autodesk.co.uk), intellectual property (IP) specialist Barker Brettel (http://barkerbrettell.co.uk) and Lloyds Bank (https://is.gd/okotoz).

PRAISE FOR GTMA INITIATIVE

Opening the Reshoring UK event in early September at Seco Tooling’s Alcester, Warks, headquarters where the GTMA is itself now located, Julia Moore, GTMA CEO, encouraged companies to get involved and join the 1,600 companies already ‘on the map’ at the Reshoring UK website.

She said: “There are a lot of opportunities for engineering companies to be involved and one of the roots is to come via a trade association. The collective vision of the nine trade associations, as it is at the moment, [is to] move us forward to build that connected network for the manufacturing sector. To help them [OEMs] understand that the skills are available in the UK and to say to them ‘before looking outside, look to your neighbour’.”

Underlining the GTMA’s achievement in developing and growing its reshoring initiative, Lloyds Bank’s Dave Atkinson, UK head of manufacturing SME, paid tribute to Moore’s efforts over the past couple of years in driving the project. “You should be really proud of what you have achieved,” he said, adding:

“I remember you talking to me two years ago, explaining your vision of what you wanted to create. To see that evolve, with the benefits that it could bring and the impact it might have; I think it could be quite instrumental [in boosting reshoring]. Congratulations to you and your team.” A justified round of applause was the response.

Underlining the bank’s interest in manufacturing, Atkinson went on: “We are a UK-focused, commercial and retail relationship bank. One of the best capitalised banks in the UK and very proud of the strategy that we have evolved since the financial crisis, that of supporting UK industry. Our strategy, to support clients through the cycle, through challenges as well as good times, remains unaltered. Over the past six or so years, we have demonstrated that by considerably outperforming the market. Our net lending to SMEs over the past six years has grown by 28%. The vote to leave the EU has made no difference to our strategy.” And Lloyds Bank’s commitment is to add an additional £1 billion of new lending for manufacturers every year until 2017.

But Atkinson’s main theme was investment, specifically in automation and robots. And citing a Copenhagen Business School report, he highlighted that, were the UK’s level of investment in automation to be the same as the best (Japan, followed by Germany), its productivity level would be 22.3% higher across all manufacturing sectors, while employment would be over 7% greater.

More specifically for this event, he highlighted the bank’s Tooling Finance offer (https://is.gd/imiriq) that can provide up to 90% of funding for a period of up to 24 months; financing the SME until production starts and tooling is paid for.

And this linked neatly to top speaker of the day, Jaguar Land Rover’s Mike Mychajluk, supply chain and external engagement manager, and a member of the Automotive Council’s Supply Chain Group.

BIG FISH IN A GROWING POND

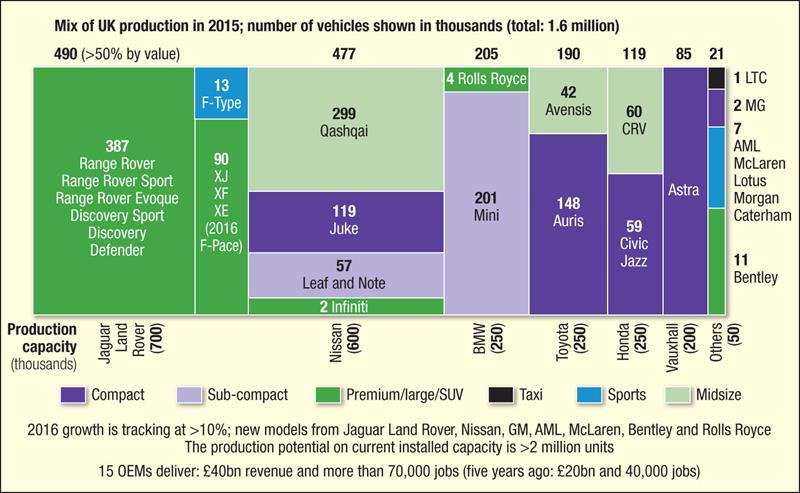

Jaguar Land Rover’s importance to the UK automotive industry and to the UK can be summed up in a few headline figures– JLR produced 490,000 vehicles in 2015, placing it first, ahead of Nissan’s 477,000; it is responsible for 8% of all the UK’s manufacturing exports; £10 billion has been invested by JLR in the country in the last five years – 70% of all UK automotive investment – while there has been a further £1 billion invested by its supply chain, with £250,000 in the pipeline; it employs 35,000 directly and claims a further 240,000 in the wider economy; plus, importantly for this event, the company has a strong commitment to increasing its UK supply chain.

Indeed, it is JLR corporate policy “to support the UK economy through our procurement practices”. Some 55% of its spend is with UK component suppliers, amounting to £13 billion. It is in pole position on the UK sourcing front, in fact. And post the Brexit vote, Mychajluk says that JLR has not changed its strategy; referencing automotive sector expert professor Garel Rhys (read the Wales Online article: https://is.gd/zufuga) it will be “business as usual, as if nothing happened” for the auto sector after Brexit. For JLR specifically, Mychajluk confirmed that it was “business as usual”, but added that the company’s presence in Slovakia will give JLR an inside-the-EU voice via organisations such as the European Automobile Manufacturers’ Association.

It has to be said that he was speaking before JLR’s chief executive Ralf Speth’s Reuters-reported statement from September’s Paris car show: “We are the only car manufacturer in the UK to do all the work in terms of research, design, engineering, production planning in the UK. We want to have fair treatment [post Brexit] and a level playing field at the end of the day.” His comments followed those of Nissan and Toyota saying that tariffs could hurt UK production (see also p7). But that is still all for the future and lobbying positions are to be expected. And August’s manufacturing PMI figure of 53.3, from 48.3 in July, was linked to a 2.5% jump in the transport equipment production, incidentally.

JLR and this current analysis aside, the amount of UK sourcing (reshored, increased volumes, new product) has clearly grown, according to the Automotive Council figures revealed by Mychajluk. In five years, UK sourcing by the whole automotive industry has grown from 36% of vehicle content by value in 2011 to 41% in 2015. And UK supply chain revenues have grown from £20 billion from £30 billion (75% domestic; 25% export).

JLR's Mike Mychajluk outlined the UK's automotive players and highlighted how they and UK sourcing had grown

JLR's Mike Mychajluk outlined the UK's automotive players and highlighted how they and UK sourcing had grown

A figure of 60% UK content is considered the maximum achievable for a car by the Automotive Council, incidentally, and earlier this year the Society of Motor Manufacturers and Traders heralded that the UK automotive supply chain was missing out on a further £4 billion of sourcing (www.machinery.co.uk/141396). More to go for, then. But JLR’s Mychajluk said that his supply chain is already full; new suppliers need to demonstrate real benefit to the company, was the message.

Autodesk’s senior industry manager, manufacturing industry strategy and marketing, Asif Moghal, outlined a vision that might help suppliers offer that something, setting out the company’s ‘Future of making things’ message (www.machinery.co.uk/113935). This has two streams – the product, and the related design and manufacturing processes.

On the product side, this is centred around consumer product personalisation for a ‘market of one’; those that offer a user experience and provide a vehicle for the sale of connected services. On the design and manufacturing side, it includes a number of tools: cloud-hosted software available anywhere that supports constraint-driven automatic part design and collaborative working, plus leading-edge additive and subtractive manufacturing tools. And overarching all there’s social media, allowing rapid direct communication and feedback between various parties.

Companies can get “competitive separation” by adopting the vision and employing Autodesk offerings (01252 456600) to drive product, process and service innovation, Moghal indicated, making this relevant to the automotive sector by saying: “If you are in the supply chain, your business is going to be impacted by big players coming to you and saying ‘I need you to be more innovative’.”

And on innovation, IP protection specialist, Andy Tranter of Barker Brettel had some advice for suppliers collaborating with OEMs. First off, he asked the assembled audience whether any of them knew who their company’s IP specialist was; hardly any hands were raised. A visit from an IP specialist to perform an IP audit can be had for about £1,000, he advised.

An interesting fact, he offered, is that since 1999, while manufacturing patent numbers overall have grown by 3%, those in the automotive industry, according to US figures, have grown by 10%. And with innovation being driven down the supply chain, reshoring by OEMs makes sense as this offers tighter control, a common legal framework and swifter resolution, should a supplier go out of business, he said. Also, reshoring will, in return, drive innovation further down the supply chain, Tranter added. But the IP specialist advised that when working with large OEMs, suppliers check terms and conditions to see who owns any developed IP, adding that they may wish to ensure their existing IP is protected by using a non-disclosure agreement (NDA – https://is.gd/vesole).

IP – PROTECT AND BENEFIT

He highlighted that while most people think of IP protection in terms of patents, there are six types of protection – unregistered design; registered design; copyright; trademarks; patents; and trade secrets/confidential information. So, having undertaken an IP audit, he said companies should act on it, using one of the six protection mechanisms where sensible, and develop an IP strategy.

Benefits of IP include: corporation tax side (R&D tax credits and Patent Box); a positive entry on a balance sheet; a source of income via licensing deals; and sending customers a positive company message. “Get out there and sell your IP – work with people,” concluded Tranter.

Judged by the automotive market, reshoring is clearly underway, and the GTMA’s Reshoring UK initiative aims to get more engineering suppliers actively engaged in proactively winning back more work for the country. And with an unfavourable currency rate for importers following the Brexit vote, onshore manufacturing may have been given a further positive boost.

Main feature ends

Box item

Manufacturing process innovation

Event organiser the GTMA outlined two processes that it is bringing to the UK’s automotive industry: its own incremental sheetmetal forming (ISF), which is a machine tool-based process where a single point ball-end rod pushes material over a die, gradually stepping down, plane by plane (video: https://is.gd/ikolab), and, second, automated composite part lay-up and curing from French firm Techni-Modul Engineering. ISF is not new, but Roger Onions, GTMA business development director, told the assembled gathering that there was interest from UK automotive firms in part prototyping and in low volume classic car parts manufacture.

On the composite side, using an aerospace I-beam as an example, a robot-based automated cell was highlighted (video: https://is.gd/saruqu). In this, composite material is cut, preforms created using formers, the preforms assembled to an I-beam tool (with the tool also assembled by the robot during the process), the tool placed in a press and encased in a mould tool, and resin injected at room temperature to produce a part, all in about six minutes.

This article was published in the November 2016 issue of Machinery magazine.