[Updated:17/3/16 - UK market figures corrected] As at mid-December last year, MACH 2016 (www.machexhibition.com) had already surpassed MACH 2014, in terms of total commercial space allocated, as it has moved beyond the 22,247 m2 mark seen at the previous edition of the award-winning event (http://is.gd/nPTkJH). Organised by the Manufacturing Technologies Association (MTA), more space has since been taken, with the show expected to draw in the region of 600 exhibitors and more than 23,000 visitors (registration is live at http://is.gd/wDY2eO).

An indication of the positive atmosphere and expanded offering can be seen in the number of companies exhibiting that are new to MACH. This year that figure stands at 130, which, according to James Fudge, head of events at the MTA, is about 30 above the norm. And this year, MACH is, he suggests, a show that will demand two days’ attendance to fully digest the two-hall affair.

The MTA, by the way, is the UK’s representative body for companies involved in the construction and supply of manufacturing technology, taking in machine tools, workholding, cutting tools, metrology (measuring) equipment and CADCAM software. Other members deploy these technologies within their factories (OEMs and subcontractors), while still more are involved in providing services to the industry. The organisation boasts some 330 members.

In describing MACH exhibitions as the largest such event in the UK, there is a number that serves to amplify that standing. These every-other-year shows are associated with hundreds of millions of pounds worth of expenditure, with the 2014 edition being linked to £177 million of business. With 2014 implied UK consumption of manufacturing technology (machine tools, cutting tools and work/toolholding equipment) standing at £1.3 billion (source: MTA Basic Facts 2015), that means MACH 2014 can be linked with 14% of consumption [updated from £711 million and 25% respectively - £711 million is machine tools only]. And the economic backdrop is favourable to MACH 2016, even though, at first glance, there is cause for concern, as MTA head of external affairs Paul O’Donnell, explains.

UK GDP growth of 2.5% is in line with the Bank of England’s figure, he starts, adding that this is trend for the UK on average and describes it as “pretty good”. And he reminds the audience that the UK was in negative quarter-on-quarter growth territory for some five quarters, starting in the second quarter 2008 and ending in the third quarter of 2009. Year-on-year GDP ‘growth’ hit -6% in the first quarter of 2009. In fact, it was the deepest UK recession since the war, with manufacturing output declining 7% by end 2008.

IT’S STILL GROWTH

With that sobering reflection out of the way, O’Donnell goes on to say that although there is a slowdown in rate of GDP growth, growth there nevertheless is. But there are several end user sectors within this and he picked these apart, breaking them down into automotive, aerospace, metal products and machinery sectors, major buyers generating that £711 million 2014 consumption mentioned above.

Says the head of external affairs: “The automotive sector is powering away, set to make more cars in any year since [the all-time high of] 1972; the aerospace sector, again – recession, what recession? – continuing on a strong path. And there is every expectation that those two industries will continue along those trajectories. Projections for the civil aerospace industry going forward over next 30 years, as people in Asia, Latin America and Africa start to fly more regularly, show a hugely strong future for that industry.” In painting this upbeat picture, he refers to the automotive sector’s ONS output index figure of 125 and aerospace’s 115 (2012=100), and whose January 2005 positions were 105 and just over 60 respectively.

Metal products, at an index of just over 100, is “at a reasonable level”, O’Donnell offers, but he pays particular attention to the ONS’ ‘machinery’ output index that shows a level of around 80; lower than 2005’s January figure of around 90. This area is core MACH audience territory.

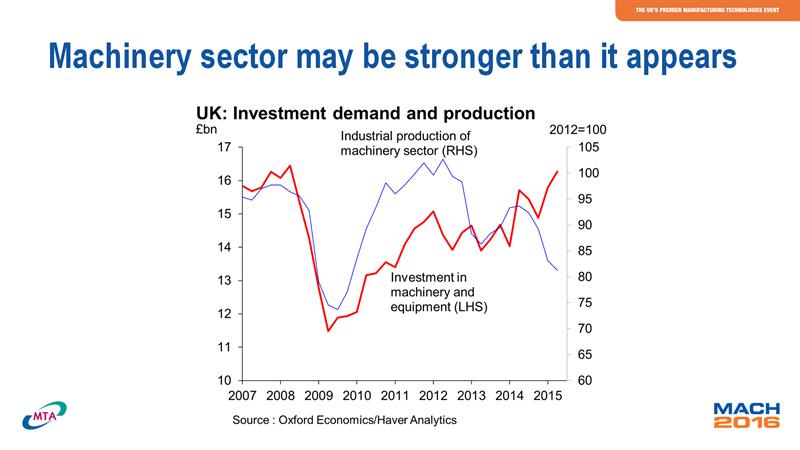

The ‘machinery’ sector includes manufacturing technologies, but also includes pumps and seals for the North Sea, as well as construction equipment, which has exposure to China, he explains, but draws attention to two similar dips in the ONS index graph in January 2013 and a larger dip in December 2008 (diagram, above). “This [January 2013] is not that [December 2008],” he emphatically points out, adding that another dip in January 2015 may have additionally helped to drive the ‘machinery’ index “out of kilter with where it should be”. And he says: “We, the MTA, believe that is a statistical anomaly, an error, a quirk; that fall [in January 2013] did not happen in one month.”

And he reveals further analysis that sees a graph of ‘investment in machinery and equipment’ overlaid onto this official index graph. A wide divergence is seen starting at the beginning of 2014, with the investment index indicating a level of just over 100 just as the official ONS data is showing an index of 80 as at early 2015. “You would expect there to be a relationship between those two lines, but there isn’t.

And thinking back to January 2013, there simply wasn’t that downturn [as indicated by official data].”

Graph comparing investment in machinery and equipment with industrial production, supporting the argument that the machinery industry is performing better than expected.

Graph comparing investment in machinery and equipment with industrial production, supporting the argument that the machinery industry is performing better than expected.

THE REAL POSITION

This is good news, he emphasises, saying: “This is where we think end users of manufacturing technology in the UK, that is MACH visitors, are [100+ index level]. So, as you can see, it’s a good strong picture going forward.” Indeed, he notes also that business investment is growing at a faster rate than the economy as a whole, notwithstanding the fact that the UK’s investment rate is low, compared to other countries, he admits.

O’Donnell concludes by looking at machine tool investment figures for the UK, a key component of MACH business and a major area of MTA member focus. Since the 2009 fall to an index level of 85 (2010=100), with the high point of 2007 seeing a value of almost 150, the index climbed to a level of almost 180 in 2014, falling back to below 170 last year but is expected to climb to 170+ this year, he advises. “We can see that investment is running at levels above where we were prior the great recession. We think this bodes really, really well for MACH 2016.” And of the early January reports of negative month-on-month manufacturing growth for November last year, he told Machinery in mid-January that this hit was mostly in power generation and pharmaceuticals, and that his positive outlook is undiminished for the sectors he outlined in December.

James Fudge picks up the baton and amplifies this positive message, by highlighting that the exhibition is filling a full two halls this time, and details how the show is bigger and better. As at mid-December, Hall 5 was sold out and full, unlike MACH 2014 where some empty space remained. “That is a great indicator of how the industry is feeling and is also great for MACH, as we know it’s going to be a good show. Similarly for Hall 4, most of the available space is sold, while the 2014 space sales figure [overall] has been exceeded.”

That’s bigger, but what about better? Fudge points to the seminar programme as a core element that has been expanded. There are two seminar theatres, with speakers from Messier-Bugatti-Dowty and Airbus attending again, but who will be joined by speakers from McLaren Automotive, Cranfield University, the Manufacturing Technology Centre (MTC), Lloyds Bank (economics) and the HS2 project. “HS2 will make the NEC included in Zone 5 of the London Underground,” Fudge quips, highlighting the expected 30 min journey time, but additionally underlining that the seminars will be focusing on supply chain issues – how to become a supplier to such companies – with these supported by evening networking events.

HEAVYWEIGHT TOPICS COVERED

Two technology seminars are arranged for two heavyweight subjects: additive manufacturing/3D printing; and Industry 4.0. The former was MACH 2014’s most popular seminar, Fudge highlights, adding that speakers from Germany, home of Industry 4.0, will be flying in to support the latter.

This seminar programme backs up the established MACH technology zones, association pavilions and other special in-show areas of interest (see box, below), while large OEMs are increasingly being drawn to the biennial event. In addition to aerospace giants Airbus and Messier-Bugatti-Dowty, McLaren Automotive (with a composites theme), Siemens (automation and power generation) and the MoD (training and skills) will have large displays.

“With a more enhanced offering for our visitors and the experience they can have, and the fact that the show is bigger, we actually believe that MACH 2016 may be a show you need to visit for two days,” Fudge offers, adding: “We have tried to accommodate as best we can extended opening hours, so we are opening half an hour earlier, but we really are suggesting to people that they consider spending two days at the exhibition.”

It all augurs well for MACH 2016 and, more importantly, show visitors who are the ones that will be drawing on the biennial event in their efforts to drive UK manufacturing forward.

BOX: MACH 2016 technology, zones, association pavilion and more

Technology zones at MACH 2016 take in:

- UK Manufacturing zone (Hall 5), taking in supply chain companies and OEMs (plus hosting one of the seminar theatres) – expanded area for MACH 2016.

- The Measurement and Inspection zone (Halls 4 and 5) – expanded area for MACH 2016.

- Software and Design Solutions zone (Hall 4) - expanded area for MACH 2016.

- Additive Manufacturing/3D printing (Hall 4) - expanded area for MACH 2016.

- Surface finishing and component cleaning (Hall 4) - expanded area for MACH 2016

- Engineering and lasers

- Grinding and abrasives

- The Learning and Development zone, sponsored by Sandvik Coromant, comprises several elements – a large education and training theatre; the AMRC technology demonstrator vehicle, MANTRA; the Bloodhound project; the MoD’s new recruit training and ex-service personnel resettlement programmes; and MTA member company apprentices/graduates at work.

Pavilions at MACH 2016 take in:

- The British Turned Parts Manufacturers’ Association

- The Association of Welding Distributors

- The Metalforming Machinery Makers’ Association

Other associations represented will be :

- The Association of Industrial Laser Users

- The British Abrasives Federation

- The GTMA

BOX ITEM

Lloyds Bank backs MACH 2016

MACH headline sponsor Lloyds Bank has committed an additional £1 billion of new lending for manufacturers every year until 2017 to drive growth in the sector (http://is.gd/lcPWAN). Head of manufacturing, SME commercial banking at Lloyds Banking Group, David Watkins, says that in an effort to best support the sector, the organisation is working with the University of Warwick's Warwick Manufacturing Group on a sector-specific training programme for the 106-odd managers involved in this area. This is topped up by 40 hours of continuing professional development, with this supported by the MTA. Activity such as this, plus its attendance at MACH and more “will hopefully see Lloyds as the go-to bank for manufacturing over a period of time, if we invest our time in taking part in key events such as this”.

This article was first published in the February 2016 issue of Machinery magazine.