Extended article box items:

The AFRC’s place in Scotland’s manufacturing plan

That globally-present German press maker Schuler has for several years chosen to work with the Advanced Forming Research Centre (AFRC; https://is.gd/hkmOmO) tells you much about the credibility of the Inchinnan, Renfrewshire, Scotland-based institution. Germany is Europe’s pre-eminent machine tool maker and has no shortage of technical universities and Fraunhofer institutes, many of which work closely with the country’s machine tool sector. Why travel to Inchinnan?

The reason is that the AFRC has all the elements required to support successful research and process development on one site, as Dr Lynne O’Hare, chief business development officer, explains: “We take a holistic approach to R&D for metalforming operations. Under our roof you can establish how your material will perform and its forging condition, as opposed to its service condition. So we can simulate material deformation at high temperatures, at high and low strain rates, in argon, in air; we can use that data to build numerical models; those models then allow us to predict processes that should be used; having predicted that, we can demonstrate that at full scale here or at a customer’s facility; we can validate output – geometry, texture, shape, properties, residual stress; then feed that back into the initial material selection and parameter selection. We have an optimisation loop here that is very powerful. You can get parts of that elsewhere in the world, but we are not aware of anywhere else that can offer this holistic service.”

Apart from Schuler, the AFRC has a number of international members, however (more:https://is.gd/adonuk). The R&D organisation is one of seven centres that make up the UK government’s High Value Manufacturing (HVM) Catapult – establishments that bridge the gap between academia and business, offering industry easier engagement with academia and helping to develop early stage knowledge (technology or processes) into something that can be taken on further within factories.

AFRC ORIGINS

Some of these centres predate the setting up of the HVM Catapult in 2011, however. In the AFRC’s case, its roots are in 2008; brought into being by the University of Strathclyde (its owner) and backed by Scottish Enterprise, Scotland’s main economic development agency. Many of the HVM centres have industrial members (Schuler is a Tier 2 member at the AFRC – see online feature, ‘The network effect’) and today draw their funding equally from contract research (from members and non-members), competitively won grants and, since 2011, UK government funding (the latter up for renewal this year for another five-year term). The AFRC has so far benefited from circa £60 million of funding for buildings and equipment.

Machinery readers will probably be more familiar with Sheffield University’s Advanced Manufacturing Research Centre with Boeing (mostly referred to as the AMRC), where, since 2001, metalcutting has been a core activity. As it happens, one of the AMRC’s founders and its current executive chairman, Professor Keith Ridgway CBE, is now also executive chairman of the AFRC. And also as it happens, within a recently added area at the AFRC, there is now a collection of DMG Mori (02476 516120) metalcutting equipment, as there is at the AMRC (DMG Mori is a Tier 1 member at both the AMRC and the AFRC). But there will be collaboration not cross-over; the AFRC will build on its metalforming credentials.

The DMG Mori cell at the AFRC, where metalcutting research involving forged parts is underway, extending the organisation’s sphere of activity

The DMG Mori cell at the AFRC, where metalcutting research involving forged parts is underway, extending the organisation’s sphere of activity

Having provided two pieces of equipment as part of its Tier 1 membership starting in 2015, DMG Mori represents a “first-in-kind” for the AFRC, underlines O’Hare, who says: “This is a fantastic opportunity, as we get the chance to rotate machinery through the shop, with latest models brought in to replace previous ones. It’s already happened, in fact. And we’re excited about being able to feed back to DMG Mori data about machine performance and how it works for us.”

Referencing this metalcutting diversion, the chief business development officer goes on to detail the AFRC’s work further: “There is a fundamental difference in the type of machining that we do here [versus the AMRC]. Stephen Fitzpatrick’s team [senior manufacturing engineer, machining and additive manufacturing team lead, see later] is focused in large part on dies – tooling design, manufacture and repair, not just for our own purposes but also for customers –and that’s not the same operating space as the high speed machining area of the AMRC. So, looking at high speed machining, it is about understanding machine harmonics to get maximum speed [of material removal]; we are more interested in the residual stress in a forging that you would put onto the machine in order to pick a machining strategy that combines absolute speed with [minimal] final part deflection and distortion.

“So we are working with our other departments – materials science, residual stress – to understand how what you put on a machine, beyond its geometry, contributes to the quality of the component. That is complementary to the AMRC’s work and recognised as such. Machining’s all about geometry, and forging is all about [material] properties; bringing the two together is quite a different research focus to the AMRC.”

Adds chief operating officer David Jones: “Our underpinning materials capability is recognised within the Catapult by some of our industrial partners who see it as a key competency of the AFRC, and it is something we have invested heavily in [see online article for more detail].”

More broadly, he says: “We are able to offer that [metalcutting] technology to Scottish manufacturers. It’s a long way from Aberdeen to Sheffield [the AMRC]. We have a big offer to the oil and gas industry, for example. But we do cooperate and share information with the AMRC, when we are able to do so.”

Continues O’Hare: “We still have a forming and forging core to the business, but going forward see an increasing demand for slightly different technologies. So we now have more metalcutting machines and, in the future, will be looking at additive and subtractive methodologies.

“In addition, we are also seeing demand for more automation, sensing and big data analysis, with this helping to broaden our scope of activities, and we are seeing this demand specifically in Scotland. So we have two aims: to continue to act as that global centre of excellence in forming and forging, and, more broadly, to service the local economy in Scotland; general manufacturing.” The latter is tied up with the Scottish government’s manufacturing vision (see box below, 'The AFRC’s place in Scotland’s manufacturing plan', for more).

METALCUTTING PROJECTS

As Machinery is given a tour of the DMG Mori hardware, it is the residual stress work element that Stephen Fitzpatrick picks up on. He highlights how, as a manufacturing engineer at Rolls-Royce, he could tie down every part of a manufacturing process, but plans would always be upended by distortion caused by stresses introduced when forgings are quenched and that are subsequently released during machining.

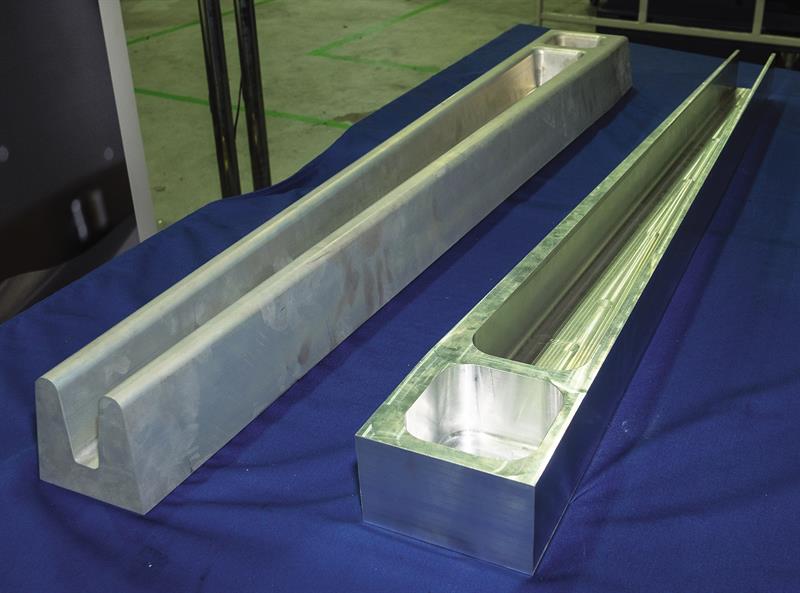

Standing by the DMG Mori ‘DMU 125 FD duoBLOCK’ 5-axis mill-turn (1,335, 1,250, 900; X, Y, Z) that arrived last year, he points to a scale-size aircraft aluminium 7075 structural forging (pictured).

The scale-size aluminium aircraft structural part that is the subject of residual stress machining trials

The scale-size aluminium aircraft structural part that is the subject of residual stress machining trials

“The machining of this takes a large number of operations and it still then has to be bent to achieve the finished result,” he says. Supported by the residual stress laboratory set up some two years ago, the AFRC has, over the past year, been working to build an FEA model to support predictable machining outcomes. Staff first build the base FEA model for a heat-treated and quenched part and material, measuring temperature at various component locations during quenching, and so gaining a residual stress picture of the part that informs the applied machining strategy. With that knowledge, components are then machined in stages on the DMU 125 FD. Dimensional measurements are taken on the machine (via MSP’s NC-PerfectPart software; 01665 608193) and also off-machine on CMMs or the AFRC’s GOM vision system (02476 639920), with information about how the part moves following various machining strategies fed into the FEA model to update it, improving its prediction capability. The next 12 months will see the AFRC apply various machining strategies, based on the developed FEA model. More efficient production and less waste are two of the benefits here.

Work is also now starting on an Inconel 718 jet engine rotating part, initially on a part made from bar rather than a forging, however. The same process will be applied – heat treat then machine – while testing this against the developing FEA model for the part and material. In this case, turning work is supported by a DMG Mori ‘CTX beta 2000 TC’ 5-axis turn-mill (550 mm diameter by 2,050 mm length part capacity) that also arrived last year.

Stephen Fitzpatrick at the controls of the DMG Mori CTX beta 2000 TC 5-axis turn-mill – the workpiece is a rotary engine part undergoing FEA model-based residual stress machining work

The analysis of residual stress is also being employed to understand an internal issue, the life of dies used on the AFRC’s WF Maschinenbau STR 600-316 flow-forming/flow-shearing machine (see box below, Metalforming investment, for more). Failure is related to the high loads applied during the process, with stresses within the hardened die then being released, causing fracture.

This detailed residual stress work builds on previous efforts undertaken at the AFRC on the machining of die sets via various strategies to improve tool life and wear-resistance, to which O’Hare referred earlier. A DMG Mori ‘HSC 75 linear’ (750, 600, 560 mm; X, Y, Z) 5-axis vertical machining centre, installed in 2015, supports high speed machining finishing cuts that are of key importance in this area. Typically, H13 tool steel in the hardened state is machined using Mitsubishi Miracle-type cutters (Mitsubishi Materials [MMC Hardmetal, 01827 312312] is a Tier 2 member).

A significant proportion of the cost of a formed part can be imparted by tooling cost, so reducing that is key, O’Hare indicates. (Tool repair using laser-based material deposition versus flood weld fill is another area of investigation.)

The growth of the AFRC, in space, manufacturing equipment numbers and type, areas of activity, plus supporting facilities like the residual stress lab, is also reflected in the increase in staffing numbers. These have grown from 12 in 2009, prior to moving to the current site from University of Strathclyde, to around 140 today. To obtain the required expertise, the AFRC scours the world – it boasts individuals from 26 different nations. The proportion of women is also worthy of note – “more than 40% of engineers are female” – but not a result of any policy, O’Hare adds; they employ the best and that’s how it falls.

This increase in size supports greater activity, which prompts still further growth. And the AFRC’s expansion is far from finished, with its importance to the Scottish economy, in particular, set to increase, following the publication last February of the nation’s ‘manufacturing action plan’.

Magazine article ends - extended version from here

Box item 1

The network effect

The AFRC sits within a network: the HVM Catapult itself, its industrial members (national and international); its industrial clients; academic and research links via the University of Strathclyde; Scotland’s Oil & Gas Innovation Centre; the Renewable Energy Catapult; Scottish Enterprise key clients (including inward investors), and Innovate UK (government support for innovation).

Tier 1 industrial members shape core AFRC research and share developed IP (the residual stress/machining programme is an example of core research). Tier 2 members benefit from networking potential with Tier 1s, by showcasing their manufacturing technology at the AFRC and through knowledge gained via the use of their equipment within research programmes. And the latter means they are then in prime position to supply it when new processes are implemented within industry (Tier 2 membership is currently being reviewed to broaden its appeal).

For example, Schuler supplied the first-of-a-kind servo-driven forging press to the AFRC and has now taken knowledge gained over three years in its application into future models, while the AFRC has purchased the original prototype machine and become a reference site for the Schuler. The German press maker has sold machines incorporating this technology, too. O'Hare suggests that a similar type of relationship will develop with DMG Mori.

Collectively, the industrial members form a supply chain of OEMs, suppliers at various levels and manufacturing equipment suppliers that the OEMs and suppliers use. While this has very much been aerospace focused up to now, there is an increasing automotive interest, says O'Hare, with Tier 1 member Bifrangi having a foot in that camp as well as aerospace, for example. In addition, a growing non-member industrial client base takes in oil and gas, medical, power generation and renewables, as well as automotive; from one-man firms to large multinationals.

Box item 2

Metalforming investment

While having recently added metalcutting machinery to its tally, the AFRC continues to bolster its metalforming equipment quota. Another German machine tool builder, WF Maschinenbau, has renewed its Tier 2 membership with the AFRC and will supply new machinery. A manufacturer of chipless manufacturing equipment, flow-forming and flow-shearing machinery, it will be supplying a VUD600 vertical flow-former to the facility. Complementing the existing horizontal spindle STR 600-316 flow-former (600 by 4,000 mm maximum part diameter and length, and the largest flow-former in any research centre in the world). It will be used to expand the capabilities, allowing smaller, more complex and a wider size-range of components to be produced.

The STR 600-316 flow-former - the largest such machine in a research establishment worldwide, claims the AFRC

The STR 600-316 flow-former - the largest such machine in a research establishment worldwide, claims the AFRC

The AFRC also has an ACB 1200-ton superplastic forming/600-ton hot creep-forming press. This backs up the smaller ACB Loire 200-ton superplastic forming press, allowing production of large full-scale aerospace parts for a range of applications, including jet engine components. So it can take the preliminary scale-size part work undertaken on the smaller machine up to full size. It is another piece of kit that differentiates the AFRC – “a unique capability”. Hollow jet engine fan blades and nacelle structures are within its capability. French firm ACB is also a Tier 2 AFRC member.

A forthcoming investment supported by the government-backed Aerospace Technology Institute (http://www.ati.org.uk) to the tune of £6.6 million will see a large-capacity, open- and closed-die, isothermal hydraulic press installed within yet another extension to the AFRC, with the press anticipated as arriving in late 2018, early 2019.

Box item 3

Helping SMEs

The AFRC carries out core research programmes with its Tier 1 members, such as Rolls-Royce and Boeing, but it is keen to support local SMEs in innovating products and processes. Indeed, SME engagement is one of the measures of successful activity and it has ramped up efforts over the past 12 months, says O’Hare. The AFRC attended and sponsored the Scottish Manufacturing Advisory Service (SMAS) conference for the first time last year to promote itself to such companies and will do so again. It is also working with Scottish Enterprise initiative Interface and has put on internal events.

SME engagement, mostly meaning local firms, is one of the activities by which the AFRC is measured as having an impact. The target for 2016/2017 is 240 SME engagements and this figure had already been met as at Machinery’s early December visit, with another three months left in its reporting year.

Says chief operating officer David Jones: “One of the challenges with SMEs, as well as their lack of ability to travel, is that they don't really have the bandwith, necessarily, to think about innovation. One of the things that the team here has done is a 'Ready for Innovation' approach. So it's important that we understand how a company operates and what they can do to innovate. When we get them here for events, it sparks a few ideas and they realise that they have a competitive edge on which to innovate. We are being much more proactive, like attending the SMAS [Scottish Manufacturing Advisory Service] event; trying to let people know we are here, and that is particularly important for SMEs, who don't have time to trawl around to find people to help them.”

Two examples of successful SME engagement are titanium cranial implants (replacement skull parts) and an electric bike. In the first, these are made via incremental sheet forming (ISF) using a ‘punch’ held in a milling machine’s spindle pressing sheet into a die, bit by bit. In doing this, an implant can be created within one day, instead of the six weeks required currently. This technical sheet metalworking example required the AFRC’s materials’ knowledge. The company, Pascoe Engineering, which has no previous link to the medical sector, has already gained the required medical certification and is now awaiting first use within Scotland. This project was aided by Pascoe Engineering networking with the AFRC and Tier 1 member Boeing, plus other connections that led to the medical sector opportunity.

The electric bike saw the AFRC aid Glasgow-based FreeFlow Technologies in developing a lightweight and efficient pedal assist e-bike. This was achieved through an innovative gearing technology system. The AFRC carried out a design review to identify design changes in order to reduce the cost of manufacturing prototypes. In addition, a workshop held by the AFRC with FreeFlow Technologies explored alternative methods of manufacturing; balancing design and product criteria against manufacturing process constraints.

Box item 4

Scotland’s plan for manufacturing and the AFRC

Part of the overall plan envisages a “Centre for Manufacturing Excellence and Skills Academy”. Scotland’s first minister, Nicola Sturgeon (SNP), recently visited the AMRC and its training academy, while the SNP website adds that there’s to be a National Manufacturing Institute for Scotland, saying: “The centre will provide support to Scotland’s manufacturers, to help them compete in international markets and support Scotland’s industry in terms of innovation and digital opportunities.

“This is a major, transformative project being developed by the Scottish Government and Strathclyde University [owner of the AFRC], alongside the Scottish Research Partnership in Engineering, enterprise agencies, Skills Development Scotland, the Scottish Funding Council and the private sector.”

This article was published first in Machinery magazine, January 2017